The money market is to a commercial nation what the heart is to man.

—William Pitt, 1805

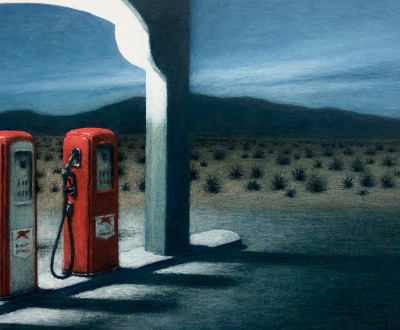

Evening Sounds (detail), by Michael Chapman, 2018. © Michael Chapman, courtesy Arcadia Contemporary, Los Angeles.

Audio brought to you by Curio, a Lapham’s Quarterly partner

Oil and sand are not often commodities conjoined in discussions of global trade. The first is the motive engine of industry and transportation, fuel for heating and illumination, the spirit that animates much global politics. Even when priced cheaply—as I write, the price of oil hovers around fifty dollars per barrel (or just under four hundred dollars per ton)—it is considered precious. Humble, ordinary, oft-overlooked sand is, by contrast, the second most consumed good in the world by volume after water. It makes concrete and glass and electronics possible. According to the UN Environment Programme, at least fifty billion tons of sand (often measured in aggregate with gravel) are used annually, in contrast with four billion tons of oil. But sand is not often thought of as valuable: its trade is more domestic than global, and its market price per ton is under nine dollars in the United States and far less than that in the rest of the world.

But there are similarities, too. While China is the biggest consumer of both products, the United States follows close behind as the world’s second-largest consumer of oil and the third-largest user of sand. Depending on its market price, crude oil is often the first or second most exported good in the world by value. Today’s relatively low prices put crude oil exports in second place, after automobiles. At the end of 2015, the U.S. government rescinded a forty-year ban on the export of crude oil from the States, and since then the country has aggressively reentered the global oil market, becoming the world’s third-largest exporter of petroleum and its refined products, behind Saudi Arabia and Russia. (Despite being the largest oil producer, the U.S. is not the world’s largest exporter, because it consumes most of what it produces.) The vast majority of the trade in sand is domestic, and the U.S. and China extract the sand they need for construction and industry from their own territories. The world’s biggest importer of sand, however, is Singapore, which uses a great volume of the stuff in its frenetic projects of land reclamation.

The two commodities converge in one other regard. Their commodification and trade hold mirrors to global inequalities and ecological plunder. Both are produced over eons, the one a product of fossilization of prehistoric flora and fauna, the other the debris of rocks’ encounter with wind and water. Both tar and dirt symbolize inferior material. And yet the moment at which they became pivotal to industrialization and urbanization, rocks are blasted, wells are drilled to sepulchral depths, rivers are dredged, beaches are bulldozed away to enable the transformation of these natural resources into commodities. The inexorable proliferation of oil and sand on the global circuits of trade tells us about the shape-shifting ways of production, colonial forms of exploitation, and our reckless wrecking of the global environmental commons. It is about how the commodification of prosaic everyday things affects lives here, now, and half a world away.

If you look around you, you will inevitably see objects, places, things containing sand. Sand is dredged out of a riverbed or a seafloor in one place and poured into the shallows in another place to conjure land out of the sea. Sand and gravel are used in the making of concrete, today the most widely used building material in the world. Mixed with tar, sand and gravel constitute asphalt. The silica in sand is extracted to manufacture all grades of glass, as well as semiconductors and integrated circuits used in electronics. Even hydraulic fracturing, or fracking, requires sand. The urbanization of the world, the meteoric growth in the production of electronics, and the expansion of the use of glass in everything from windows and fiberglass to screens for automobiles and electronics all have increased the demand for sand. But the largest consumer remains the construction industry.

Throughout human history sand and gravel have been used to raise buildings, pave roads, and make glassware. Monumental structures of ancient times—the Great Wall of China, Roman aqueducts and amphitheaters, and ziggurats and pyramids in Mesopotamia and the Americas—used either early versions of concrete (blending some adhesive with sand and gravel) or fired mud bricks made from a mixture of sand and clay. The massive blocks of stone for the pyramids in Egypt were dragged into place on beds of sand. Glass-cutting techniques were employed in the Sassanian Empire, and glass windowpanes made from sand quartz and ash were known in Roman Alexandria nearly two thousand years ago, though they were opaque, small, and thick. (Until the early modern period, glass panes were—like many other technologies—reserved for elite sacred and profane institutions: cathedrals, jami’ mosques, and grand administrative buildings.) The glorious Hagia Sophia, built in the sixth century, was illuminated by large glass panes in its dome. Urbanization in the early modern era fueled the usage of sand and gravel needed for the expansion of cities and the arteries that facilitated circulation within and between them. But until recently, the sand and gravel used for these purposes were almost always mined and transported locally. (The exceptions were prized construction materials such as specially colored marbles and hardwood timber.) Transporting such heavy cargo using either human or animal motive force was costly and slow.

The Adoration of the Magi, detail of a triptych from the workshop of Gérard David, c. 1520. The Metropolitan Museum of Art, The Jack and Belle Linsky Collection, 1982.

Oceanic transport of building materials took off only from the fifteenth century onward, with the colossal expansion of maritime trade across the globe that came with colonialism. Sand and gravel were not immediately considered commodities to be traded across the seas; their large-scale maritime transportation was a side effect of seaborne trade itself. Ships are “in ballast” when not carrying cargo: when not laden, they float too close to the surface of the sea and can list. Ships not in cargo have to carry ballast to sail true. Before steamships fueled by coal (which acted as ballast), sand, gravel, and shingle were used. Landscapes were harvested for ballast, which was then dumped on quaysides halfway around the world. The discarded gravel and shingle from the ballast hills were employed in roads, buildings, and railroads, all of which underwent continent-wide expansion in the Americas, Europe, and their colonies in the nineteenth century.

The trade in sand and gravel as commodities in their own right began in earnest in the twentieth century. The efflorescence of modernist concrete architecture with large windows and the later fashion for glass cladding in ever-expanding cities demanded concerted and organized trade in sand, rather than the accidental use of ballast. And with the invention and upward spiral in the usage of electronics at the end of the twentieth century, the search for industrial-quality sand became more urgent.

Not all sand is created equal. The fine sand of the desert, stretching for miles across the arid climates, has been eroded by wind, becoming too uniform in size and too even in shape to make good concrete. Concrete is manufactured by mixing cement with a larger proportion of sand; unevenly sized and shaped grains of sand better facilitate the adhesive effect desired of cement. The grains of water-eroded sand are irregular in shape and dissimilar in size and thus ideal for making concrete. As the demand for concrete has skyrocketed and technologies for making it have improved in the past fifty years, the world has grown famished for sand. Residential and commercial buildings, agglomerations of skyscrapers, and sprawling exurbs all devour concrete. Land reclamation requires pouring dredging by-products, sand, and concrete blocks into the sea, creating property ex nihilo. Islands such as Bahrain and Singapore have pushed their landmass further into the sea through this process. A 2014 Financial Times investigative report showed that a secretive investment vehicle owned by Bahraini royals was granted deeds to undersea plots of land; after reclamation these became coveted and expensive ground for the development of luxury hotels and commercial buildings. By some accounts China has used more cement between 2011 and 2013 than the U.S. did in all of the twentieth century. If concrete requires at least twice as much sand as cement, then the volume of sand involved in producing billions of tons of concrete today boggles the mind.

Over the millennia oil, naturally seeping out of the earth, has been used as fuel for lamps and heaters and as an emollient for skin ailments. The industrial exploitation of petroleum via hand-dug wells had begun in Russia’s Azerbaijan region a decade or so before oil gushers were drilled in mid-nineteenth-century Pennsylvania. The gradual replacement of coal by petroleum as a source of energy took nearly a century and was not linear, decisive, or entirely complete. It was a transformation intimately bound up with the global ambitions of the earliest oil companies. The large-scale extraction of oil in the U.S. was concurrent with the country’s rise as a global economic power and with its colonial expansion, both on the American continent and in the Caribbean and the Pacific. Across the Atlantic, Britain’s control over vast coal reserves drove industrialization and fueled colonization of immense expanses of Asia and Africa. Though Britain did not try to control oil production at first, its commercial fleets were the largest in the world, carrying other countries’ petroleum across the oceans. As production of its precious coal gradually declined, Britain consolidated power in the Middle East through the eventual control of oil production there. For a time, using oil as the fuel for its ships also secured Britain’s long-standing maritime mastery.

A shopkeeper will never get the more custom by beating his customers; and what is true of a shopkeeper is true of a shopkeeping nation.

—Josiah Tucker, 1766Outside the United States, oil was most abundant in places where the great powers had already asserted claims to dominion: the southern Caribbean, contested by both the U.S. (via the Monroe Doctrine) and the British Empire; the Caspian basin, where the Great Game gave way to anti-Bolshevik activities by Euro-American powers; and the Persian Gulf and Southeast Asia, where Britain (and later the U.S.) held sway. In all these places, the exploration of oil was intimately bound up with colonial regimes of labor exploitation and an international color line that facilitated them.

The magisterial Cities of Salt by the late Saudi author Abdul Rahman Munif is a petro-novel that richly describes these global hierarchies. Incorporating magical realism, satire, and folk-story tropes—and portraying a cast of hundreds of Arabs, Americans, and Europeans—Munif mines invisible and forgotten tales of oases destroyed, dissenters assassinated, strikes broken, and potentates and technocrats bought by oil companies. This is a world of exploited workers and engineers trapped in pecking orders shaped by race and geography. The Americans of his stories are the masters to whom even the local emirs and dignitaries pay obeisance. After them come the Europeans, and below them are the English-speaking skilled Arabs from other lands. The men who do the grueling menial work are the Arabs who were formerly fishermen and pastoralists and whose autonomy has become hostage to wage work.

Such racial ordering of labor remains in force aboard the massive tankers that trade in oil today. While seafaring crews hail from the global south (largely from the Philippines), the officers are often Russians, Ukrainians, or Eastern Europeans, and officers and crews are paid radically different wages based on their countries of origin. The stratification of labor has been exacerbated by the emergence of “open registries,” or what the International Transport Workers’ Federation calls “flags of convenience.” Many more tankers than container ships are flagged to open registries, in part because the very history of flags of convenience was forged in oil trade, and in part due to the market fragmentation of the tanker trade, making it more vulnerable to profiteering.

When a ship flies the flag of a given country, it has to obey the rules and regulations of that country. Open registries allow ships owned or operated by shipping companies in Europe or the U.S. to be “flagged” to Panama or Liberia (or dozens of other countries, some even landlocked), where the enforcement of environmental or labor laws is lax, taxes are scant, and scrutiny and accountability are nearly nonexistent. The U.S. first set up open registries after World War I, principally for the benefit of U.S.-based shippers operating banana boats and oil tankers, foremost among them the United Fruit Company and Standard Oil of California. To burnish company profits, companies paid lower wages than the home-country standard, ran hunger ships, and jettisoned expensive safety rules. (B. Traven’s harrowing and thinly fictionalized 1926 novel, The Death Ship, retells the stories of a parade of such ships.) At some stage in the early twentieth century, the vast majority of U.S. oil tankers shifted to the open registries of Panama, Liberia, and the Marshall Islands, all faithful client states.

Ivory traders posing with elephant tusks, Zanzibar, c. 1900. Rijksmuseum.

The trade in oil under flags of convenience was considered such fertile ground for profit that after the end of World War II, when Greek shipping magnates cornered the market on oceanic transport, the cleverest (or most unscrupulous) of them, Aristotle Onassis, bet everything he had on oil tankers. While his Greek rivals were buying up bulk carriers, suitable for transporting ore and grain, Onassis bought decommissioned oil tankers from the wartime U.S. Transportation Command at a steep discount, commissioned new ships with novel if somewhat shady methods of finance, and deployed them all to transport oil to countries famished for the fuel needed to fire up postwar reconstruction and development. Doris Lilly, one of his many biographers, hinted at another reason why oil tankers were such a good bargain for Onassis. Even in the earliest decades, tanker loading and unloading was far more automated than loading dry-cargo ships. You needed pipes to carry oil to the ship that were capable of latching to the vessel’s holding tanks, and you needed valves and sensors to gauge how full the hold was, but only a handful of workers were needed to manage the whole process. Loading bags and pallets required far too many stevedores at the docks, many unionized, demanding fair wages and safe working conditions. Reducing the number of workers at the docks, Onassis likely reasoned, reduced the possibility of worker resistance and increased the efficiency of loading and unloading.

Onassis’ astonishing rise through the prosperous ranks of global tycoons gave him a confidence that only one of the world’s wealthiest oil companies could deflate. In the 1950s, Aramco, a subsidiary of Standard Oil of California, had a concession from Saudi Arabia for the production of oil, but its agreement did not specify the terms of export. Onassis attempted to subvert Aramco’s monopoly over oil transport by lobbying the Saudi government for an exclusive concession to ship the country’s oil. This was too much not only for Standard Oil but also for the de facto masters of oil in the region. For a time, fear reigned that Saudi Arabia might follow Iran’s example and nationalize its oil: Why else would it want an independent tanker company? A motley group of concerned actors—from the CIA and the Dulles brothers to Her Majesty’s Government in London and the other shipping mogul, Stavros Niarchos—came together to defend Aramco against such impudence. Onassis’ ships were boycotted by all oil companies, including Aramco’s rivals. Diplomats and spies flew to Riyadh to lobby the king to withdraw Onassis’ concession. As a last resort, Aramco lodged a case against Saudi Arabia (and by extension, Onassis) in a commercial arbitration tribunal in Europe. A powerful group of European and North American jurists ruled against Saudi Arabia and declared that its oil-production concession agreement had given some measure of sovereignty to Aramco. It was a decision that defended the rights of powerful Western corporations against countries from the global south asserting jurisdiction over their own oil and control over the operation and management of their own trade. For a time the supremacy of the Western oil companies was restored.

Such strong-arming was not new. Some combination of trade boycott, commercial arbitration, and violent intervention had already been used in attempts to bring intransigent nationalizers of oil to heel. Soviet nationalization of Baku’s oil companies (including that of the Swedish Nobel family) in 1920 triggered a dramatic decline in Azerbaijan’s share of the global oil market. Mexico’s nationalization of oil in 1938 moved Western oil companies to stipulate that all future concession contracts—not just in Mexico but worldwide—should be arbitrated in international courts (which benefited Aramco twenty years later). Iran’s nationalization of the Anglo-Iranian Oil Company (later BP) in 1951 led to a shipping boycott of Iranian oil and a violent British- and American-engineered coup d’état to replace the nationalist prime minister Mohammad Mosaddeq. Much of the nationalization of oil companies in the Arab oil-producing states in the 1970s was made possible only after those states made exorbitant payments to the former owners and gave these foreign firms political and financial guarantees to remain primary investors in the new oil industries. Once Middle Eastern oil was nationalized, a press and political campaign began portraying OPEC as the villain holding the world to ransom. The old stories of Western oil company depredations were forgotten, except in those places where the violence they had brought had indelibly reshaped politics and everyday lives. As Pablo Neruda wrote in his poem about Standard Oil nearly eighty years ago, the trade in oil transformed indigenous lands into “a million-acre mortgage” and forged a malign traffic in “countries, people, seas, / police, county councils, / distant regions.” These changes proved durable.

In late 2016, Phnom Penh Post reporters noted a discrepancy in Cambodia’s trade with Singapore: the latter’s customs records showed $750 million of sand imported from Cambodia, but the government of Cambodia reported exporting only $5 million. Cambodia had banned the unregulated export of sand in 2009, and the difference between the two amounts indicated the misreporting of illegally stripped sand dredged from Cambodia’s fast-depleted rivers.

The smuggling and illegal mining of sand at beaches and rivers of the global south work a bit like piracy. People whose livelihoods are destroyed by exploitation and debt work for a pittance to haul away sand from their own habitations. They are paid by corporations and businessmen in air-conditioned offices far away from the sites of despoliation. The profit margins are widest when the cheap sand is alchemized into a desirable commodity on the global trade circuits.

Countries with long coastlines and rich riverine topographies have become prey to other states and their own profit-seeking businessmen ravening for sand. Legal and illegal miners have stripped the rivers of Myanmar and Cambodia of their sandy riverbeds and sandbanks, dramatically changing flow patterns in rivers. The modified quality and volume of the sediments in such rivers make previously bountiful ecosystems inhospitable to agriculture and fishing. Turbulence in sand-poor rivers erodes riverbanks, destroys infrastructure, including dikes and bridges, and submerges riverside villages. Beaches in Senegal, Sierra Leone, and Morocco have disappeared overnight as bulldozers and trucks load their sands for use on other shores. Indonesia, an archipelago of between 17,500 and 18,500 islands (the actual number is a matter of dispute), has seen whole sand atolls disappear through illegal mining. Environmental scientists Orrin H. Pilkey and J. Andrew G. Cooper enumerate the effects of such mining in their book The Last Beach: shorelines wearing away, destruction of coastal fauna habitats, eradication of dunes and the flora that grow on them. Coastlines are more exposed to rising sea levels, tsunamis, hurricanes, and the natural roiling of the seas in storms. Building dream palaces of capitalism in one corner of the world leaves another bereft of its beaches and agricultural fecundity.

Money speaks sense in a language all nations understand.

—Aphra Behn, 1677Illegal sand mining has other casualties—not only those whose ecosystems are destroyed but also the activists who try to halt the business. In Asia and Africa, farmers and fishermen turned grassroots activists have been intimidated, beaten, and shot. In May 2017, Niranjan, Uday, and Vimlesh Yadav, three members of the same family, were killed by gangsters illegally lifting sand from the banks of a river near their village of Jatpura in the eastern Indian state of Jharkhand. In June 2018 in Gambia, police opened fire on protesters demonstrating against sand mining, killing two. Many other assassinated activists remain nameless. Whether killed by smugglers or by the police, dead activists are a harbinger of eco-wars that will only intensify as capitalist growth gnaws on the body of the earth. Oil also stars in this story of the assault on the global commons, and some of its production now requires large volumes of sand.

Fracking is a method for extracting petroleum from shale rocks. During fracking, high-pressure water is pumped through the rocks to fracture them; the water carries thousands of tons of sand into the fractured rocks to prop their fissures open. Shale oil then flows through the porous sand into extraction conduits. Unlike the sand used in concrete, frac sand is uniform in size and spherical in shape, and it can be mined only from specific sites where epochal geologic events have created homogenously hardened grains. In the U.S., which is both the largest producer and consumer of frac sand, the best deposits are found in the Great Lakes region. After extraction, frac sand goes through complex cleaning, drying, and chemical treatment before it is let loose on shale rocks.

This new application for sand also signals another major transformation in global trade: the rising importance of shale oil as a share of the market in petroleum. In 2017 the U.S. posted a notable increase in its oil output (690,000 barrels per day), compensating for a significant decline of Saudi Arabian production (−450,000 barrels per day). The U.S. has surpassed both Saudi Arabia and Russia in its annual extraction of petroleum thanks to the increase in shale oil. Fracking now yields half of all oil produced in the States. Already this new method of bringing oil to the surface is upturning lives, changing labor regimes, and endangering local ecosystems.

Portraits at the Stock Exchange, by Edgar Degas, c. 1878–79. The Metropolitan Museum of Art, Gift of Janice H. Levin, 1991.

Upon completion, the Keystone XL Pipeline will connect the oil sands of Canada to refineries on the coast of the Gulf of Mexico, picking up oil from the shale fields of the Midwest along the way. The pipeline’s U.S. route avoids cities and instead bisects Sioux tribal reservations. At every step its construction has been challenged by activists and local communities. The First Nations have defied Canada’s claim to sovereignty over the unceded territories where the pipeline originates and along much of its route to the U.S. border. The Water Protectors of Standing Rock and environmental and political activists throughout North America have contested the construction of the kindred Dakota Access Pipeline across the Midwest. Their movement to protect their lifeworlds against the ecological disasters the pipeline foretells—and has already engendered—has attracted overt and hostile undercover police action, corporate mercenaries, and business spies who have tried to infiltrate, intimidate, and divide the movement from within. The struggle is against not only the pipeline but also the explosive growth of a shale-oil industry that is a bonanza for unscrupulous modern-day prospectors and a disaster for the indigenous communities whose lives and environs are ravaged and displaced.

Constructing pipelines through domestic landscapes demands changes in titles to property or sometimes even expropriation of private or common lands. Routes crossing national borders become hostage to international conflict and may even generate such conflict themselves. Aramco’s Trans-Arabian Pipeline (TAPLine) was at the time of its completion the biggest pipeline in the world. It was constructed by Bechtel in the late 1940s between the oil fields of eastern Saudi Arabia and a Mediterranean terminus at Sidon in Lebanon. When the government of Syria resisted the passage of the pipeline across its territories, the CIA facilitated a convenient coup d’état by the Syrian army chief of staff Husni al-Zaim. The pipeline was then built through Syrian territory, even as the coup set in motion fifteen years of upheaval, coups, and countercoups in the country. Zaim was himself deposed and executed only four months after taking power. After the Six-Day War, conflict over transit fees and the Israeli occupation of the Golan Heights halted the transport of oil in the TAPLine beyond Jordan, leaving the segments in Syria, the Golan Heights, and Lebanon inoperative. When Jordan supported Saddam Hussein’s invasion of Kuwait in 1990, the Saudis terminated the flow of oil through the TAPLine altogether. By then they had built a pipeline from their oil fields on the coast of the Persian Gulf to terminals on the Red Sea, bypassing the contentious Hormuz and Bab el-Mandeb Straits. Violence has haunted not only the maritime trade of oil but also its flow through pipelines.

What makes the trade in oil so akin to the trade in sand is that the production of either commodity in one corner of the world shapes politics near and far. International trade affects each country differently, but it does have global consequences. President Donald Trump’s nationalist terms of international trade may have laid bare the scaffolding of U.S. global economic power, always defended by the country’s coercive might, always supreme whether on protectionist or free-trade terms. Yet it must be noted that trade has only ever been truly free for those whose economies were large enough and powerful enough to have a significant head start and advantage over their rivals. The effects of global inequalities are felt not only between different countries but within them. As shale oil seeps into groundwater and hydraulic fracturing generates earthquakes, as stores of sand and silt and gravel accumulated over millennia are expropriated for yet more electronics and yet more skyscrapers, trade facilitates the upward distribution of social goods held in common both locally and globally. One measure of how contentious this purloining from the commons has become is the breadth, depth, and violence of the struggles to preserve our waters, our riverbeds, that last beach.