Tax receipt for wine, Egypt, 174 bc. The Metropolitan Museum of Art, Rogers Fund, 1921.

In Scoop, Evelyn Waugh drew on his experiences in 1930s Abyssinia to imagine tax collection in fictional Ishmaelia:

It had been found expedient to merge the functions of national defense and inland revenue in an office then held in the capable hands of General Gollancz Jackson; his forces were in two main companies, the Ishmaelite Mule Tax-gathering Force and the Rifle Excisemen with a small Artillery Death Duties Corps for use against the heirs of powerful noblemen…Towards the end of each financial year the general’s flying columns would lumber out into the surrounding country on the heels of the fugitive population and return in time for budget day laden with the spoils of the less nimble; coffee and hides, silver coinage, slaves, livestock, and firearms.

It was from simple plundering of much this kind that today’s often mind-numbingly complicated tax systems evolved. Taxation may be one of the few things in our lives that our ancestors would recognize from theirs.

Something recognizable as taxation doubtless began as simple plunder in the mold of General Jackson, long before Ptolemaic Egypt or even ancient Sumer. Elements of plunder continued over the centuries. In the Roman Empire, victories were sometimes spectacular enough to allow remission of all other taxes for that year. In England, a primary function of the Domesday Book of 1087 was to provide the newly installed Norman conquerors with a record of exactly how much they had acquired. Plunder continued through the conquest of resource-rich South America, though the plunderers themselves were occasionally plundered: Francis Drake’s capture of the Spanish treasure ships (and other piracy against the Spanish in 1577–80) brought Queen Elizabeth I the equivalent of about one year of her ordinary income.

The more sophisticated plunderers have recognized that leaving those plundered just enough of their capital (and human) resources to rebuild their productive capacity can provide a basis for further happy plundering in the future. Herodotus tells of King Alyattes of Lydia, who, when attacking the ancient Greek city of Miletus, “refrained from tearing down their houses so that the Milesians could set forth from them to sow and work the fields, and through their work he would have something to plunder.” From this it was a short step to seeing that the hard work of actual plundering itself might not be needed, the threat of plundering being enough. Tribute—such as the danegeld paid by the English and the Franks to keep the Vikings from raiding—became a more elegant way to achieve, by blackmail, the same effect.

Plundering and extracting tribute from foreigners—or, more generally, from those regarded for some reason as outsiders—has always been a popular form of taxation. Rulers prefer to extract their resources from people on whom their popular support does not depend. The Athenians levied a poll tax on foreign residents; Elizabethan England simply charged them double. Machiavelli advised his prince that “of that which is neither yours nor your subjects’ you can be a ready giver, as were Cyrus, Caesar, and Alexander; because it does not take away your reputation if you squander that of others, but adds to it,” advice which many seeking to tax foreign multinationals continue to follow to this day. But taxing foreigners can be risky. And it has rarely provided enough to satisfy rulers’ needs.

As societies became more settled, so too taxation took more settled forms. In preindustrial times, it was focused on the only two things in reasonably abundant supply: agricultural land and labor.

In ancient China, for instance, during the Western Zhou dynasty (1046–771 bc), there emerged a system of dividing land into equal-sized three-by-three parcels of nine square plots, with the produce of the collectively farmed central square serving as a tax; this was much praised by the philosopher Mencius (372–289 bc), though by his time, it had largely broken down. (Unchanged, however, is the composition of the pictographic character for “tax” in China, which has always been made up of “crop” and “exchange.”) Governments have put immense resources into the collection of land-related taxes. Under the Roman emperor Diocletian (284–305), “fields were measured out clod by clod, vines and trees were counted, every kind of animal was registered.” In Japan, the primary source of revenue until the Meiji restoration was a tax specified as a proportion of (actual or potential) rice production, often paid in kind. And the Mughal emperors derived about 90 percent of their revenue from land taxes, with officials collecting field-by-field information on areas, yields, and prices. Under the British, the officials of the Raj were traveling the country doing much the same, “inspecting and checking…the state of the wells and the irrigation systems, the survey and entries in the field register, the health of the cattle, the accuracy of boundaries.”

Labor might be taxed explicitly through a poll tax: an equal amount for all (known in China as the “mouth” tax). Or it might be taxed implicitly, though forced work, often backbreaking and sometimes lethal. More glamorous was the labor required from the knights of the classic European feudal systems, obliged, in return for their share of plundered land, to provide their prince with their own military service and that of their retainers.

There were other types of tax in preindustrial societies. In classical Athens, the wealthy were effectively required to contribute to liturgies that initially paid for festivals and then for wider state functions: Pericles presented Aeschylus’ The Persians as a liturgy in 462 bc. Recognizable taxes in ancient Rome included a sales tax, which by 444 had risen to 4 percent, and taxes on inheritance and slaves (both sale and manumission). The emperor Vespasian (69–79) imposed a tax on urine, using it to teach his son the lesson that pecunia non olet: money has no smell. Classical Athens taxed imports and exports at 1 percent. But it was land and labor that were the dominant sources of the resources extracted by premodern rulers.

The elements of a clearly modern tax system began to emerge in medieval Western Europe—along with an acceptance that some degree of consent from the governed was needed if rulers were to meet their burgeoning and permanent financial needs. Traditionally, rulers were expected to “live of their own”: to fund their expenses, not least of waging war, from their own resources. These comprised income from their lands, service from their lords, and other feudal dues, supplemented by an eclectic range of expedients, such as the dissolution of the monasteries under Henry VIII. Unusual needs (meaning war) that these could not cover were met by occasional levies, often labeled in ways—“subsidies,” “grants,” or “aids” in Britain, servicios in Spain—that suggested a mutually agreeable pretense that their payment was voluntary. But from around the late fifteenth century, war became more expensive (driven in part by an existential threat from the Ottomans), requiring increasingly powerful artillery (and stronger fortifications to guard against it), along with large trained infantries. Revenue from the traditional feudal sources had clearly become inadequate in England, for instance, by the reign of James I (1603–25), and ad hoc charges, such as the sale of monopolies, did not fill the gap. The occasional special charges to finance war became increasingly regular, even in peacetime. As the search for more reliable and sustainable revenue bases intensified, commercial and other nonagricultural activities, and urban centers, became ever-more tempting targets for revenue extraction. But rulers would have to pay a price for establishing a wide and permanent source of revenue: a diminution of their political power.

One of the longest established and permanent sources of revenue—perhaps the only one that rulers were traditionally seen as having an uncontested right to impose—is the taxation of trade. Borders have long been a convenient point at which to levy taxes, and they still are, again no doubt partly in the hope of taxing foreigners rather than insiders. Trade taxes were major revenue-raisers in medieval Europe. In England, King John (1199–1216) charged around 7 percent on a wide range of both imports and exports, and much of the revenue of the medieval English kings came from a tax on wool exports. Continental Europe was cut up by a swath of tolls and charges: in 1567 traveling between Roanne and Nantes on the Loire meant crossing 120 toll points. And taxes on trade underpinned the grandeur of Byzantine Constantinople, at the junction of two major trade routes.

One consequence of rulers’ need to secure extensive and reliable revenue streams was the regularization and extension of excises (meaning taxes on the domestic production of particular products, as well as on imports), enabled by monetization and an increasing concentration of production and consumption among a manageable number of firms and cities. The alcabala in Spain, which applied to a wide range of products, dates back to at least 1342, and in France the hated salt tax (gabelle) became permanent in the 1340s. In the Florentine Republic of the Medicis, sales taxes in 1427 averaged about 6 percent of consumer spending and more in Florence itself, much of it from taxes on wine and on salt. Over the years, excises on a wider range of things began to take hold: in Spain, where the milliones of 1590 even taxed basic foods, in the United Provinces (the word excise itself may derive from the Middle Dutch word excijs) and in Britain during the interregnum of 1649–60. These attempts to expand the tax base were not always successful. Spanish efforts to impose the “tenth penny,” a 10 percent tax on all goods, further stoked the Dutch revolt of 1568–1648, and the experience of the Commonwealth bred a resistance to broad-based commodity taxation in Britain.

Nonetheless, much of the taxation of this period was intended to be differentiated according to individuals’ circumstances. The pockets—actually the fields, mills, and mines—of the well-to-do were where the money was, and perhaps also where the money should come from. Rulers could not, however, easily determine just how well-off their subjects were, especially when those subjects had an incentive not to be forthcoming, given that the more they declared the more they would be taxed. This remains a—arguably, the—central problem of all tax systems.

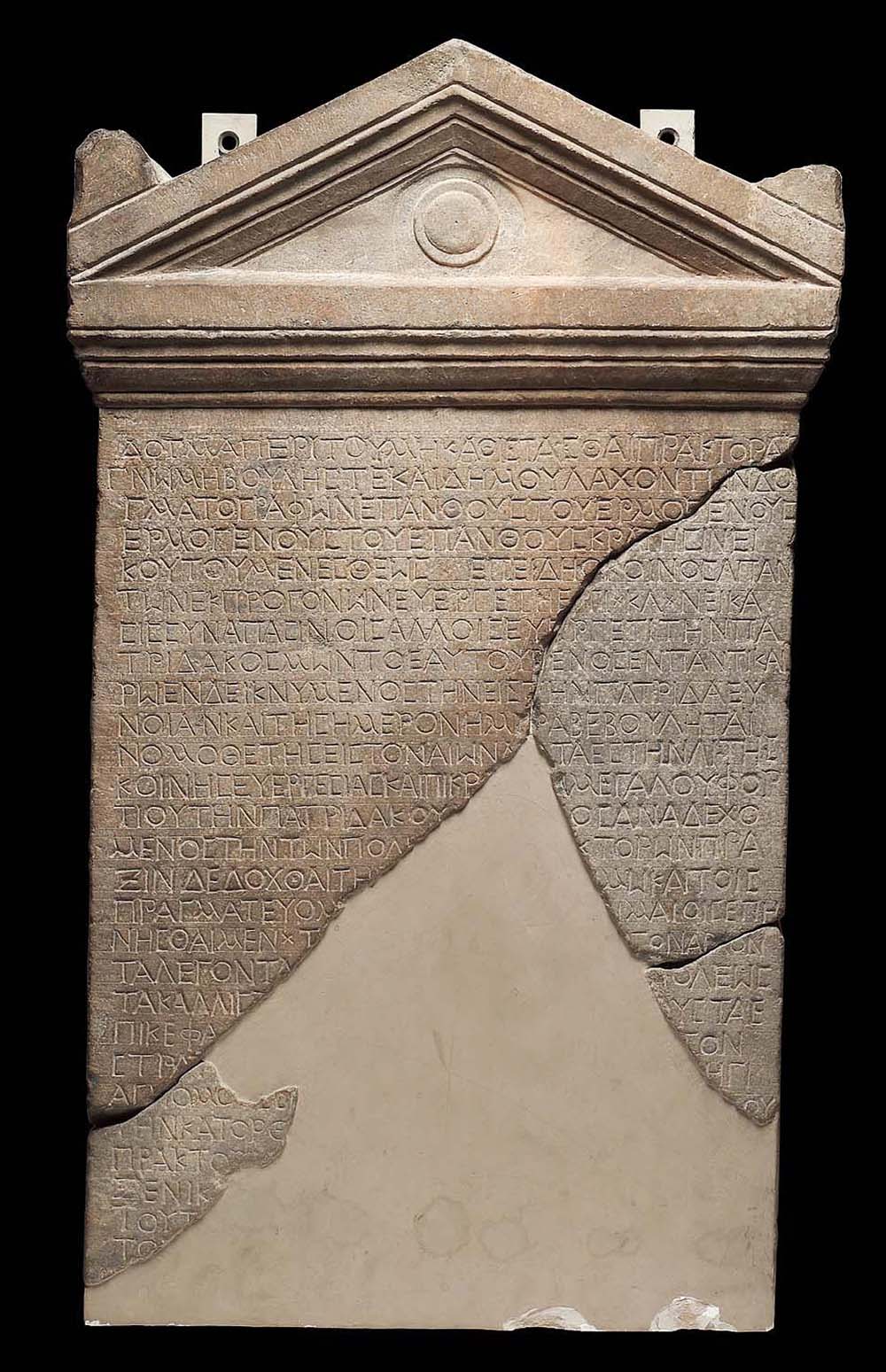

The Greeks had hit on a neat approach to this problem long ago: the wealthy could be exempted from financing the liturgies, but only if they would exchange all their property for that of someone who would take the charge on. This gave them an incentive not to egregiously understate their own wealth, for fear of ending up with less. The much more common approach to targeting the better-off was (and remains) to base an individual’s tax liability on some proxy for their standard of living, such as, in strongly hierarchical societies, their social standing, or how many windows their residences sported. Another was to effectively delegate the differentiation to the local elite, with better local knowledge and, in any case, people the ruler wanted to keep on good terms with. Sometimes this discretion operated in a context in which the amount to be paid was specified not by individual but by quotas set for each locality. Inevitably, favoritism and mendacity were pervasive: “Our estates that be £30 or £40 in the Queen’s books,” Sir Walter Raleigh told Queen Elizabeth, “are not the hundredth part of our wealth.” The commodity-based excises and tariffs, in contrast, had a much more readily observed and verifiable tax base: bales of wool could be counted.

By around the late sixteenth century, rulers’ revenue needs were making taxation not just a matter of raising extraordinary finance in times of war but a permanent reality.

Excerpted from Rebellion, Rascals, and Revenue: Tax Follies and Wisdom Through the Ages by Michael Keen and Joel Slemrod. Copyright © 2021 by Princeton University Press. Reprinted by permission.